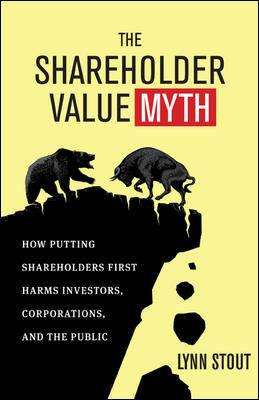

Last month, I reviewed Lynn Stout’s excellent book, “The Shareholder Value Myth,” in which she persuasively argues against the traditional belief that corporations either should (or, in fact, DO) act in the best interests of their shareholders. Among her many observations regarding commonly held misconceptions about the relationship between corporations and their shareholders is that even the word “shareholder” itself is often misleading insofar as shareholders differ dramatically in their interests, relative stakes in the corporation and styles of investing. Therefore, grouping shareholders together as a single “class” risks overlooking many critical aspects of how corporations actually function in the real world.

On February 27, the famed activist shareholder Carl Icahn released yet another strongly worded letter to eBay’s shareholders that constitutes a perfect example as to why Stout’s anti-grouping argument is such a critically important concept. His demand: nothing less than a total division between eBay and PayPal – and this from someone whose total stake in eBay is .82% . . .

In the letter, Icahn rips into the performance of two eBay directors declaring: “They appear to be value-driven for themselves, personally profiting while costing eBay stockholders at least $4 billion.” Icahn suggests that multiple conflicts of interest are currently preventing either company from realizing its respective potential and bluntly asks: “If you ran your own company, would you ever allow your competitors to sit at the table as you planned and executed your business strategy?” Not surprisingly, Icahn’s answer is a resounding NO.

Seeing as I obviously don’t have enough information to evaluate the substance of Mr. Icahn’s arguments, let’s instead take a moment to examine this situation through the lens of Stout’s paradigm. Two points seem salient. First, Icahn is obviously not an ordinary investor. Not only does he have vastly greater resources at his disposal (including, presumably, allies ready to help him acquire an ever larger slice of eBay’s capitalization), he also is most decidedly pursuing an individual agenda. Of course, he’d probably retort that, instead, he’s merely attempting to act in the best interests of the shareholders. And ultimately, he might be right. But either way, his activism proves that even a single shareholder can unilaterally define what those “best interests” are. Moreover, any move as drastic as breaking up a massive corporation is never going to benefit all shareholders equally. Some “interests” are indeed more equal than others.

The second important point is that while Icahn himself is referencing “the best interests of the shareholders,” he is doing so while actively opposing the corporation in which he holds shares. Thus, Stout is again proven correct. Not only do the views of management, board members and shareholders frequently fail to align, they sometimes involve radically different goals with correspondingly differing beneficiaries. For the board members under attack by Icahn, one would imagine they disagree with his assertions and would probably claim that their vision for the company is 100% in the shareholders’ real best interests. For upper management at eBay (and within its PayPal division), numerous other factors likely apply. Then add into the mix countless additional varieties of shareholders (for example, those with short positions), who might side with Icahn because they think he’s WRONG, or others who might oppose him because they think he’s RIGHT. And these are just few examples – potentially taken from hundreds.

The primary take-away for investors, board members and employees of public corporations is that not only do corporations frequently not act in their shareholders’ best interests, but that evaluating a company requires a far more intricate understanding of who is actually controlling the levers of power, what their motivations are likely to be and what results should logically be expected to follow. Yes – the calculus here is infinitely more complex than the traditional model – but that’s also what makes this particular insight so valuable.

In sum, Stout’s thesis is filled to the brim with practical everyday wisdom. The notion that share price alone can measure a company’s value and/or future performance is simultaneously over and under inclusive. It is fundamentally outdated. It is precisely what she says it is: a myth. And myths are simply not effective tools when it comes to making important financial or corporate governance decisions.

You can (and should) purchase your copy of “The Shareholder Value Myth†from Amazon.com in print or electronically at the following link: