AÂ “cordial” dinner, eh?

AÂ “cordial” dinner, eh?

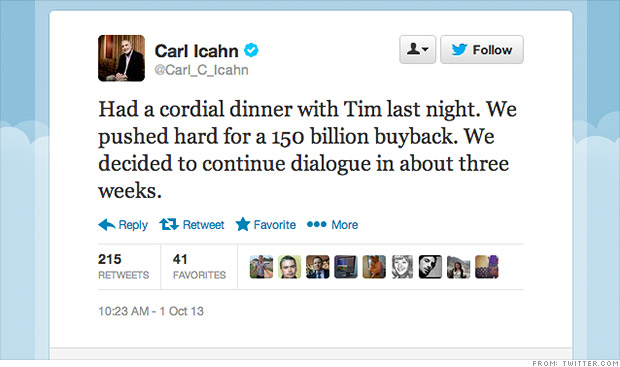

Two interesting announcements from renowned activist investor Carl IChahn this week: First, his decision to post an open letter to Apple CEO Tim Cook urging immediate action on his previously announced view that Apple should (in Icahn speak, read “MUST…”) immediately institute the the $150 billion buyback plan he has been pushing for roughly six months, and second, that he would be launching something called the “Shareholders’ Square Table” – effectively an investor counterpart to the Business Roundtable that he views as a necessary step toward restoring an appropriate level of balance between the upper management of large public corporations and those companies’ actual owners.

With regard to the buy-back, Icahn explained:

“The S&P 500 trades at roughly 14x forward earnings. After backing off net cash, Apple trades at just 9x (not factoring into account that the company has a significantly lower cash tax rate than the rate Wall Street analysts use). This discount (cash adjusted) becomes even more compelling given our confidence that Apple will grow earnings per share at a rate well in excess of the S&P 500 for the foreseeable future. With such an enormous valuation gap and such a massive amount of cash on the balance sheet, we find it difficult to imagine why the board would not move more aggressively to buy back stock by immediately announcing a $150 Billion tender offer (financed with debt or a mix of debt and cash on the balance sheet).” [Full Text of Icahn Letter, Business Insider, 10/23/2013]

Icahn argues his plan could immediately generate an increase in Apple’s sagging share price by as much as 33% and has now also agreed to withhold his own growing stake in the company to avoid any perceptions regarding conflict of interest.

Personally, I haven’t studied Apple’s numbers nearly closely enough to offer a genuinely informed view as to the correctness of Icahn’s opinion (nor am I in any way suggesting how investors and potential investors should interpret this proposal. Nevertheless, like many others on the Street, I’ll admit a degree of confusion as to Apple’s vast volume of cash-on-hand relative to its surging competitor Google, for example. I do think there is a strong alternative argument that R&D and manufacturing are other areas in need of attention – particularly with Apple losing its once dominant market share to Android and Samsung. Nevertheless, if Icahn is right, it may well be possible for the company to simultaneously gain a higher share price AND place itself in a more competitive position. Either way, looking forward to seeing how it all plays out – not to mention how aggressive Icahn becomes should Cook decide to go a different direction . . . (A possible Proxy fight has already been “suggested“)

As for the Shareholder’ Square Table concept, I’m intrigued. If you take a look at its first manifestation, you’ll note it’s classic Icahn with imagery of a peasant army attempting to scale the walls of a castle defended by greedy CEOs fighting back with “weapons” bearing labels like “worthless stock,” “lawsuits” and even “New Jets.” The idea, however, has genuine substance – providing email updates and an online forum aimed at bringing shareholder activism into the mainstream through increased information and dialogue. My view has always been that informed investors are a net positive both for themselves and the companies whose stock they’ve purchased (or intend to short). So long as the site doesn’t slip into driving particular agendas and behaves as a genuinely objective “information exchange,” Icahn may indeed be providing a valuable new service for market participants.

Expect much follow-up as all this develops during the coming the months.